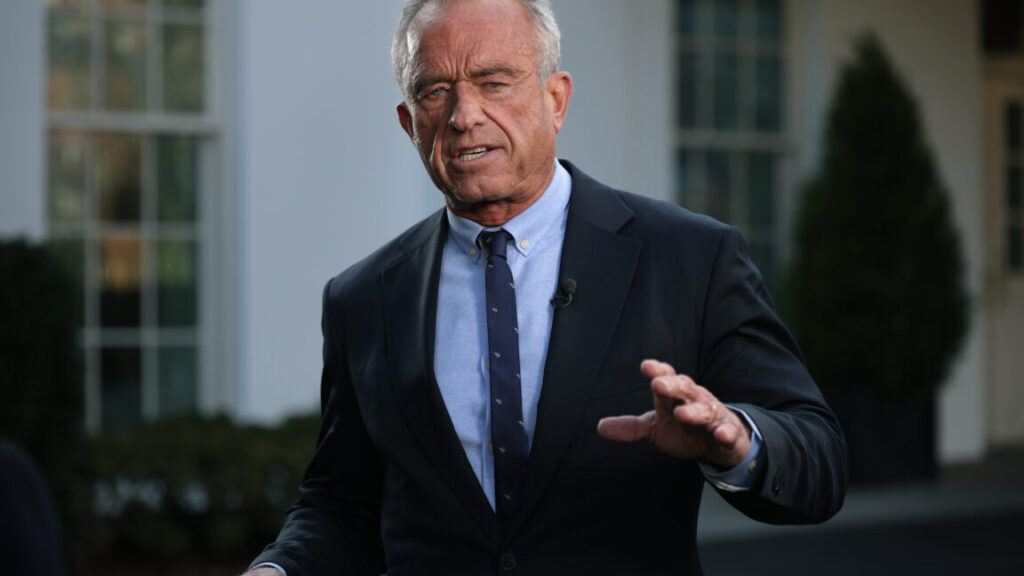

FDA deletes warning on bogus autism therapies touted by RFK Jr.‘s allies

For years, the Food and Drug Administration provided an informational webpage for parents warning them of the dangers of bogus autism treatments, some promoted by anti-vaccine activists and “wellness” companies. The page cited specifics scams and the “significant health risks” they pose.

But, under anti-vaccine Health Secretary Robert F. Kennedy Jr.—who has numerous ties to the wellness industry—that FDA information webpage is now gone. It was quietly deleted at the end of last year, the Department of Health and Human Services confirmed to Ars Technica.

The defunct webpage, titled “Be Aware of Potentially Dangerous Products and Therapies that Claim to Treat Autism,” provided parents and other consumers with an overview of the problem. It began with a short description of autism and some evidence-based, FDA-approved medications that can help manage autism symptoms. Then, the regulatory agency provided a list of some false claims and unproven, potentially dangerous treatments it had been working to combat. “Some of these so-called therapies carry significant health risks,” the FDA wrote.

The list included chelation and hyperbaric oxygen therapy, treatments that those in the anti-vaccine and wellness spheres have championed.

Dangerous detoxes

Chelation is a real treatment for heavy metal poisoning, such as lead poisoning. But it has been co-opted by anti-vaccine activists and wellness gurus, who falsely claim it can treat autism, among other things. These sham treatments can come in a variety of forms, including sprays, suppositories, capsules, and liquid drops. Actual FDA-approved chelation therapy products are prescription only, the agency noted, and chelating certain minerals from the body “can lead to serious and life-threatening outcomes.”

Many anti-vaccine activists promote the false and thoroughly debunked claim that vaccines cause autism, and more specifically, that trace metal components in some vaccines cause the neurological disorder. For years, anti-vaccine activists like Kennedy focused on thimerosal, a vaccine preservative that contains ethylmercury. Thimerosal was largely removed from childhood vaccines by 2001 amid unfounded concerns. The removal made no impact on autism rates, and many studies have continued to show that it is safe and not a cause of autism. Anti-vaccine activists moved on to blame other vaccine components for autism, including aluminum, which is used in some vaccines to help spur protective immune responses. It too has been found to be safe and not linked to autism.

FDA deletes warning on bogus autism therapies touted by RFK Jr.‘s allies Read More »