‘I don’t see the regulators easing up on this. I think it will be quite a few years before there’s a clear stance on this [crypto regulation],’ says Ubik Group analyst’

Broader adoption of crypto related technology could drive further growth in 2022, while competition is also increasing among different blockchains and sectors, industry participants said.

The past year has proved that crypto is “not just a fad,” said Devin Ryan, director of financial technology research at investment bank JMP Securities. “This is a market where there’s been significant network effects building. And there’s a very strong vested interest in the ongoing success,” Ryan said.

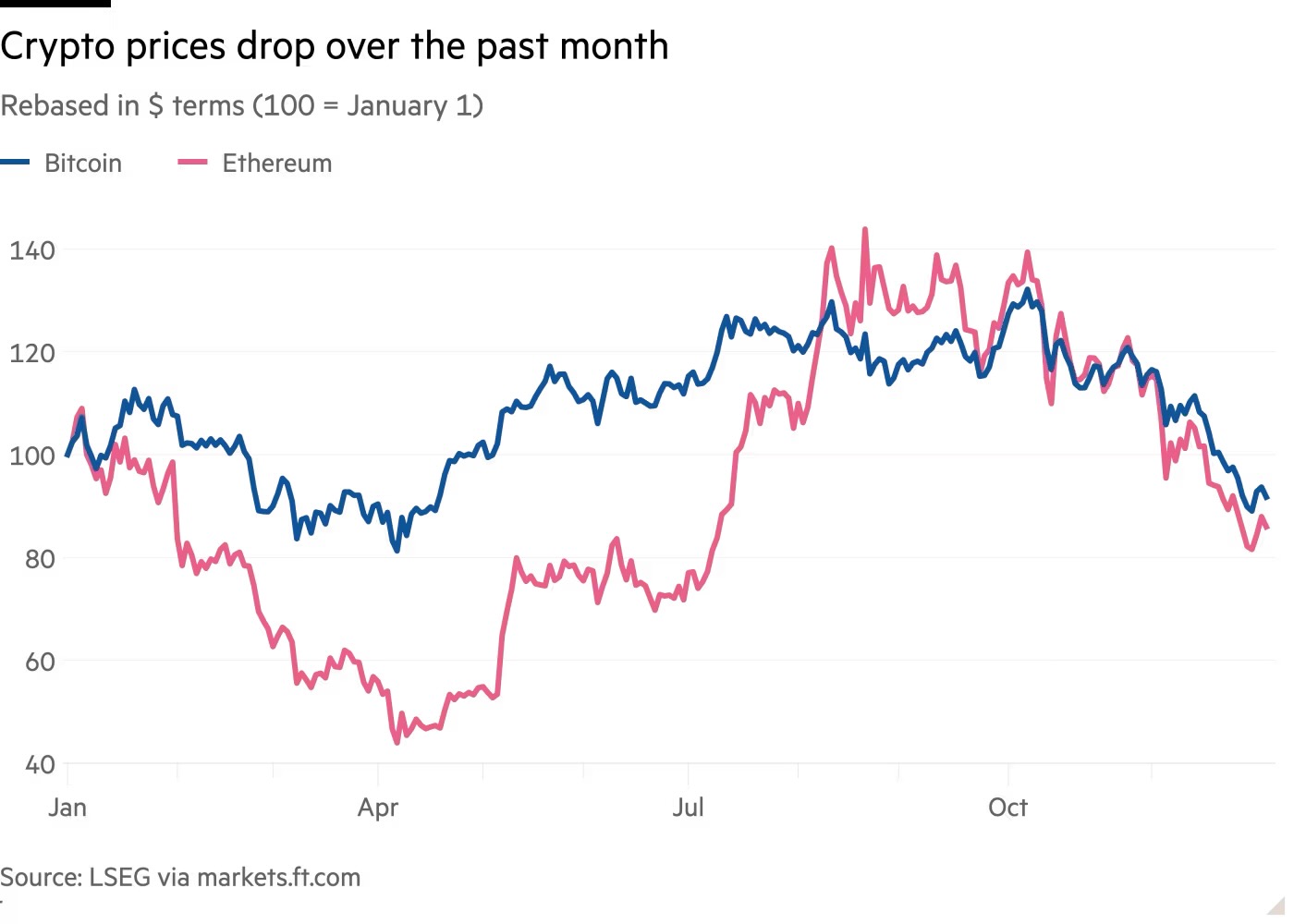

In November, total crypto market capitalization topped $3 trillion for the first time, before it fell to $2.39 trillion as of Tuesday, according to CoinGecko.

Meanwhile, the companies that are supporting the crypto economy also boast a value of $500 billion or more, according to Ryan. “This is the infrastructure companies and the exchanges and all the other plumbing and picks and shovels of the industry.”

Loukas Lagoudis, executive director at crypto hedge fund ARK36 wrote in an email that the firm expected in 2022 more “investors will see allocation to digital assets as a part of their risk management strategy, especially given the increasingly inflationary economic environment and the declining bond yields.”

Partly due to bitcoin’s volatility, “a lot of banks and hedge funds will still have significant interest in trading these cryptocurrencies,” Christopher Vecchio, senior currency strategist at Forex data platform DailyFX, told MarketWatch. “There’s an opportunity to make markets here.”

More crypto-intensive businesses are expected to go public in 2022, according to a report by investment manager VanEck XBTF, +4.08%. “There are a wide range of businesses that crypto companies can participate in — from exchanges to digital asset miners to payment companies,” the report wrote. “As the crypto market continues to grow and develop, we anticipate the market to grow with new listings, and also shift as companies win and lose market share.”

More than bitcoin and ether

As the crypto industry grows increasingly mature, some analysts expect more funds to flow into cryptocurrencies other than bitcoin and ether ETHUSD, -0.15%.

“In 2022, people will begin to understand the vast scale of what’s possible with crypto and blockchain technology,” said Diogo Monica, president and co-founder of Anchorage Digital, the first federally chartered crypto bank. “It’s no longer just speculative investing in Bitcoin or Ethereum; we’re talking about NFTs (nonfungible tokens), DeFi (decentralized finance), remittances, capital preservation, and many other verticals,” Monica said.

Some analysts expect the bitcoin dominance, which measures bitcoin’s market share of the whole crypto market, to continue to decline. Bitcoin dominance currently stands at 41%, down from 67% at the start of the year, according to charting platform TradingView.

“It’s unlikely we will ever see BTC dominance above 60% again,” Jason Desimone, head of blockchain at crypto-focused software company Ubik Group, told MarketWatch in an interview. “Bitcoin, ether, are always safe bets, but I don’t think they have the most upside, just because a lot of their value has been realized already, ” Desimone said.

Thanks to Etheruem’s high gas fees, or the computational effort required to execute operations, Desimone said some other blockchains, such as Solana SOLUSD, -0.24% and Avalanche, could gain more advantages in 2022 as competition intensifies. Ethereum is transitioning from proof-of-work to a proof-of-stake validation method, which is expected to lower the network’s gas fees upon completion.

“I think the new trend in 2022 is going to be what’s called interoperability, which means where you can migrate from one blockchain to another pretty seamlessly, pretty quick,” Desimone said. “We’re going to see a new ecosystem with a lot of undervalued tokens rising a lot.”

The crypto industry has witnessed the development of more vertical sectors in 2021, and analysts expect the trend to continue. In the past year, DeFi, saw explosive growth, as the total value locked in DeFi rose more than 270% to $98.7 billion since the start of 2021, according to data provider DeFi Pulse.

NFTs attracted unprecedented attention, as the largest NFT marketplace OpenSea saw its transaction volume growing to around $51 million from $20,650 at the start of the year, according to data site DappRadar.

Meme coin Dogecoin DOGEUSD, 1.09% traded up about 3,169% so far in 2021, while another dog-themed token Shiba Inu SHIBUSD, 4.49% rose more than 41,000,000%. Prices of Metaverse-related tokens surged thanks to the boost by Meta FB, +1.45%, or previously Facebook. Blockchain gaming, represented by Axie Infinity and The Sandbox, also gained more ground.

Regulatory clarity?

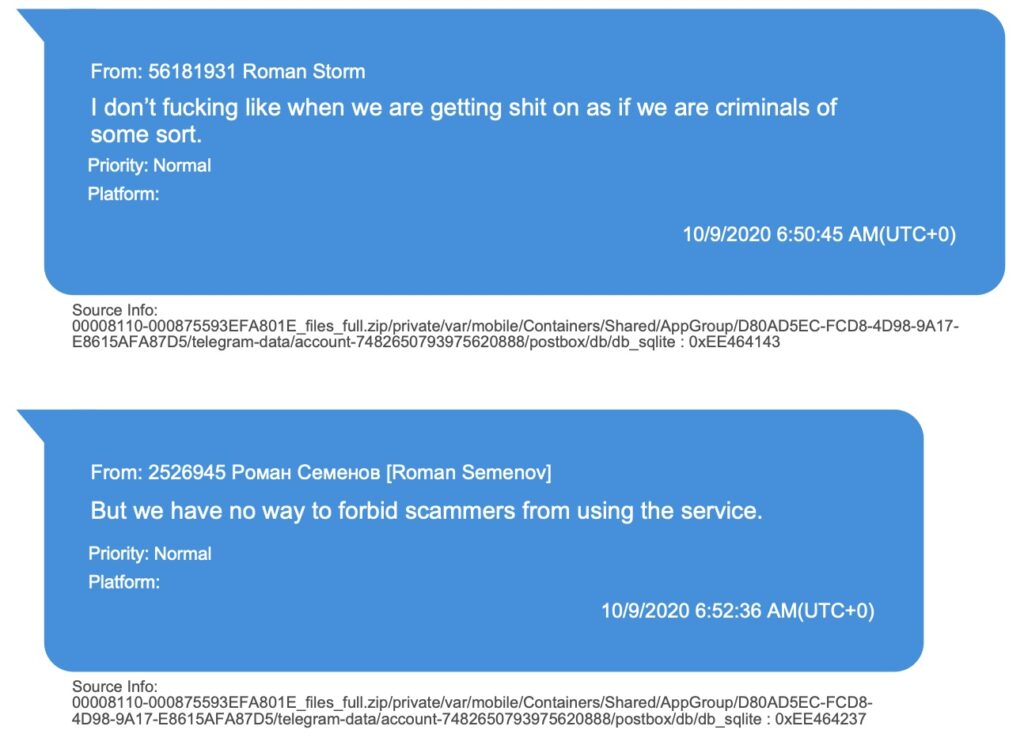

In 2021, U.S. regulators made several pushes for new rules in crypto.

The U.S. Securities and Exchange Commission greenlighted multiple bitcoin futures-based ETFs. President Joe Biden signed into law a $1 trillion infrastructure bill, which contains a provision that would require brokers of digital assets to record and report transactions to the Internal Revenue Service starting 2023. The president’s working group called on Congress to quickly pass new legislation that would require stablecoins to be issued by insured banks that are overseen by federal banking regulators.

However, uncertainties still remain, as the market ponders whether crypto lending products are securities, how stablecoins and decentralized finance should be regulated, and whether the SEC will approve a spot bitcoin ETF soon.

“The voices calling for crypto regulation, whether it be for tighter consumer protection or just clarity of the rules for institutions, are getting much louder,” Huong Hauduc, general counsel at digital asset prime brokerage and exchange BEQUANT, said in an email to MarketWatch.

Some analysts are positive that the U.S. regulators will provide more clarity in the coming year. “It’s been very nice to kind of see across the board, a thoughtful and careful approach to regulation, and very good engagement from federal regulators with the industry,” Nathan McCauley, co-founder and CEO at Anchorage Digital told MarketWatch.

However, some remain bearish. “I don’t see the regulators easing up on this. I think it will be quite a few years before there’s a clear stance on this [crypto regulation],” Ubik Group’s Desimone said. “I think what’s going to happen, unfortunately, is the smartest talent and the most capital is going to flow towards the jurisdictions that are (more) crypto friendly.”

(Visited 6 times, 1 visits today)