HBO Max is “way underpriced,” Warner Bros. Discovery CEO says

Consumers in America would pay twice as much 10 years ago for content. People were spending, on average, $55 for content 10 years ago, and the quality of the content, the amount of content that we’re getting, the spend is 10 or 12 fold and they’re paying dramatically less. I think we want a good deal for consumers, but I think over time, there’s real opportunity, particularly for us, in that quality area, to raise price.

A question of quality

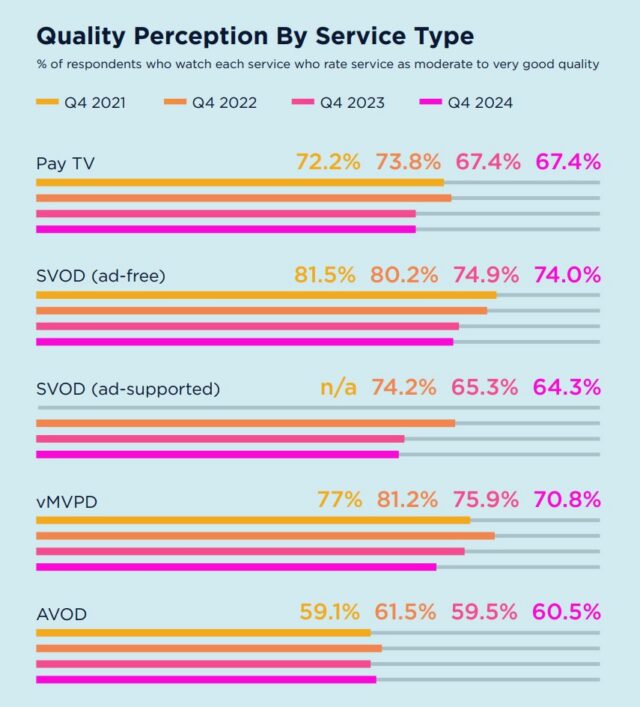

Zaslav is arguing that the quality of the shows and movies on HBO Max warrants an eventual price bump. But, in general, viewers find streaming services are getting less impressive. A Q4 2024 report from TiVo found that the percentage of people who think the streaming services that they use have “moderate to very good quality” has been declining since Q4 2021.

From TiVO’s Q4 2024 Video Trends report. Credit: TiVo

Research also points to people being at their limit when it comes to TV spending. Hub Entertainment Research’s latest “Monetizing Video” study, released last month, found that for consumers, low prices “by far still matters most to the value of a TV service.”

Meanwhile, niche streaming services have been gaining in popularity as streaming subscribers grow bored with the libraries of mainstream streaming platforms and/or feel like they’ve already seen the best of what those services have to offer. Antenna, a research firm focused on consumer subscription services, reported this month that specialty streaming service subscriptions increased 12 percent year over year in 2025 thus far and grew 22 percent in the first half of 2024.

Zaslav would likely claim that HBO Max is an outlier when it comes to streaming library dissatisfaction. Although WBD’s streaming business (which includes Discovery+) turned a $293 million profit and grew subscriber-related revenue (which includes ad revenues) in its most recent earnings report, investors would likely be unhappy if the company rested on its financial laurels. WBD has one of the most profitable streaming businesses, but it still trails far behind Netflix, which posted an operating income of $3.8 billion in its most recent earnings.

Still, increasing prices is rarely welcomed by customers. With many other options for streaming these days (including free ones), HBO Max will have to do more to convince people that it is worth the extra money than merely making the claim.

HBO Max is “way underpriced,” Warner Bros. Discovery CEO says Read More »