TSMC says AI demand is “endless” after record Q4 earnings

TSMC posted net income of NT$505.7 billion (about $16 billion) for the quarter, up 35 percent year over year and above analyst expectations. Revenue hit $33.7 billion, a 25.5 percent increase from the same period last year. The company expects nearly 30 percent revenue growth in 2026 and plans to spend between $52 billion and $56 billion on capital expenditures this year, up from $40.9 billion in 2025.

Checking with the customers’ customers

Wei’s optimism stands in contrast to months of speculation about whether the AI industry is in a bubble. In November, Google CEO Sundar Pichai warned of “irrationality” in the AI market and said no company would be immune if a potential bubble bursts. OpenAI’s Sam Altman acknowledged in August that investors are “overexcited” and that “someone” will lose a “phenomenal amount of money.”

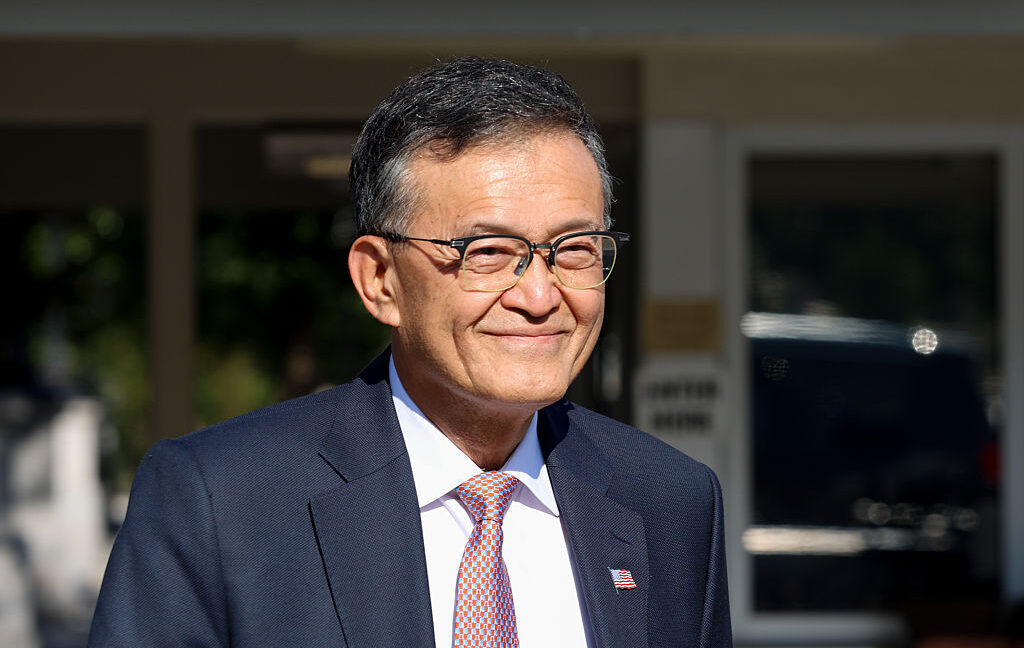

But TSMC, which manufactures the chips that power the AI boom, is betting the opposite way, with Wei telling analysts he spoke directly to cloud providers to verify that demand is real before committing to the spending increase.

“I want to make sure that my customers’ demand are real. So I talked to those cloud service providers, all of them,” Wei said. “The answer is that I’m quite satisfied with the answer. Actually, they show me the evidence that the AI really helps their business.”

The earnings report landed the same day the US and Taiwan finalized a trade agreement that cuts tariffs on Taiwanese goods to 15 percent, down from 20 percent. The deal commits Taiwanese companies to $250 billion in direct US investment, and TSMC is accelerating the expansion of its Arizona chip fabrication facilities to match.

TSMC says AI demand is “endless” after record Q4 earnings Read More »