Supreme Court to decide how 1988 videotape privacy law applies to online video

Salazar v. Paramount hinges on video privacy law’s definition of “consumer.”

Credit: Getty Images | Ernesto Ageitos

The Supreme Court is taking up a case on whether Paramount violated the 1988 Video Privacy Protection Act (VPPA) by disclosing a user’s viewing history to Facebook. The case, Michael Salazar v. Paramount Global, hinges on the law’s definition of the word “consumer.”

Salazar filed a class action against Paramount in 2022, alleging that it “violated the VPPA by disclosing his personally identifiable information to Facebook without consent,” Salazar’s petition to the Supreme Court said. Salazar had signed up for an online newsletter through 247Sports.com, a site owned by Paramount, and had to provide his email address in the process. Salazar then used 247Sports.com to view videos while logged in to his Facebook account.

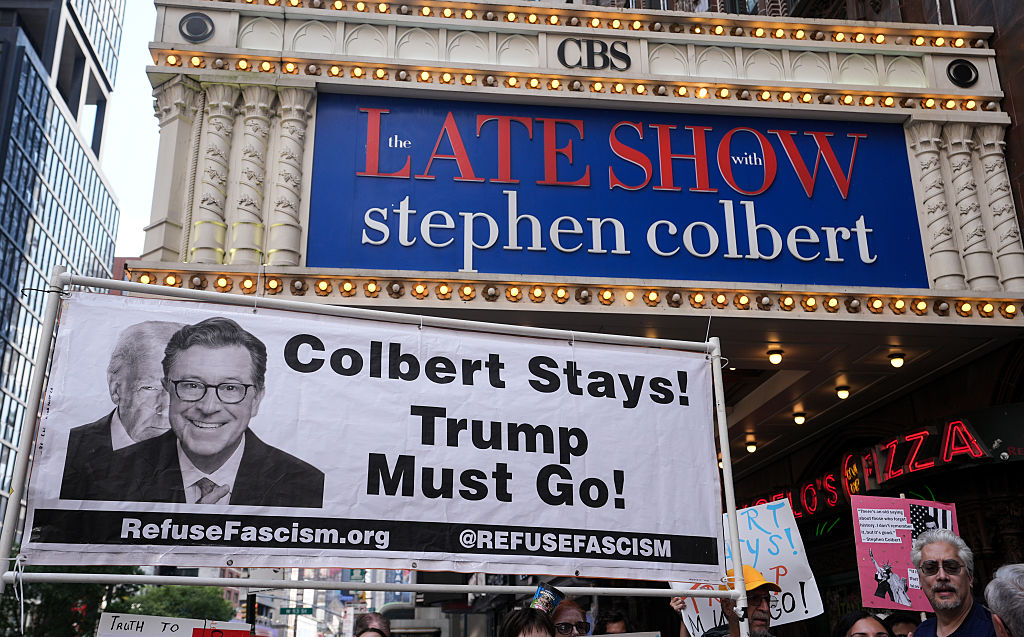

“As a result, Paramount disclosed his personally identifiable information—including his Facebook ID and which videos he watched—to Facebook,” the petition said. “The disclosures occurred automatically because of the Facebook Pixel Paramount installed on its website. Facebook and Paramount then used this information to create and display targeted advertising, which increased their revenues.”

The 1988 law defines consumer as “any renter, purchaser, or subscriber of goods or services from a video tape service provider.” The phrase “video tape service provider” is defined to include providers of “prerecorded video cassette tapes or similar audio visual materials,” and thus arguably applies to more than just sellers of tapes.

The legal question for the Supreme Court “is whether the phrase ‘goods or services from a video tape service provider,’ as used in the VPPA’s definition of ‘consumer,’ refers to all of a video tape service provider’s goods or services or only to its audiovisual goods or services,” Salazar’s petition said. The Supreme Court granted his petition to hear the case in a list of orders released yesterday.

Courts disagree on defining “consumer”

The Facebook Pixel at the center of the lawsuit is now called the Meta Pixel. The Pixel is a piece of JavaScript code that can be added to a website to track visitors’ activity “and optimize your advertising performance,” as Meta describes it.

Salazar lost his case at a federal court in Nashville, Tennessee, and then lost an appeal at the US Court of Appeals for the 6th Circuit. (247Sports has its corporate address in Tennessee.) A three-judge panel of appeals court judges ruled 2–1 to uphold the district court ruling. The appeals court majority said:

The Video Privacy Protection Act—as the name suggests—arose out of a desire to protect personal privacy in the records of the rental, purchase, or delivery of “audio visual materials.” Spurred by the publication of Judge Robert Bork’s video rental history on the eve of his confirmation hearings, Congress imposed stiff penalties on any “video tape service provider” who discloses personal information that identifies one of their “consumers” as having requested specific “audio visual materials.”

This case is about what “goods or services” a person must rent, purchase, or subscribe to in order to qualify as a “consumer” under the Act. Is “goods or services” limited to audio-visual content—or does it extend to any and all products or services that a store could provide? Michael Salazar claims that his subscription to a 247Sports e-newsletter qualifies him as a “consumer.” But since he did not subscribe to “audio visual materials,” the district court held that he was not a “consumer” and dismissed the complaint. We agree and so AFFIRM.

2-2 circuit split

Salazar’s petition to the Supreme Court alleged that the 6th Circuit ruling “imposes a limitation that appears nowhere in the relevant statutory text.” The 6th Circuit analysis “flout[s] the ordinary meaning of ‘goods or services,’” and “ignores that the VPPA broadly prohibits a video tape service provider—like Paramount here—from knowingly disclosing ‘personally identifiable information concerning any consumer of such provider,’” he told the Supreme Court.

The DC Circuit ruled the same way as the 6th Circuit in another case last year, but other appeals courts have ruled differently. The 7th Circuit held last year that “any purchase or subscription from a ‘video tape service provider’ satisfies the definition of ‘consumer,’ even if the thing purchased is clothing or the thing subscribed to is a newsletter.”

In Salazar v. National Basketball Association, which also involves Michael Salazar, the 2nd Circuit ruled in 2024 that Salazar was a consumer under the VPPA because the law’s “text, structure, and purpose compel the conclusion that that phrase is not limited to audiovisual ‘goods or services,’ and the NBA’s online newsletter falls within the plain meaning of that phrase.” The NBA petitioned the Supreme Court for review in hopes of overturning the 2nd Circuit ruling, but the petition to hear the case was denied in December.

Despite the NBA case being rejected by the high court, a circuit split can make a case ripe for Supreme Court review. “Put simply, the circuit courts have divided 2–2 over how to interpret the statutory phrase ‘goods or services from a video tape service provider,’” Salazar told the court. “As a result, there is a 2–2 circuit split concerning what it takes to become a ‘consumer’ under the VPPA.”

Paramount urged SCOTUS to reject case

While Salazar sued both Paramount and the NBA, he said the Paramount case “is a superior vehicle for resolving this exceptionally important question.” The case against the NBA is still under appeal on a different legal issue and “has had multiple amended pleadings since the lower courts decided the question, meaning the Court could not answer the question based on the now-operative allegations,” his petition said. By contrast, the Paramount case has a final judgment, no ongoing proceedings, and “can be reviewed on the same record the lower courts considered.”

Paramount urged the court to decline Salazar’s petition. Despite the circuit split on the “consumer” question, Paramount said that Salazar’s claims would fail in the 2nd and 7th circuits for different reasons. Paramount argued that “computer code shared in targeted advertising does not qualify as ‘personally identifiable information,’” and that “247Sports is not a ‘video tape service provider’ in the first place.”

“247Sports does not rent, sell, or offer subscriptions to video tapes. Nor does it stream movies or shows,” Paramount said. “Rather, it is a sports news website with articles, photos, and video clips—and all of the content at issue in this case is available for free to anybody on the Internet. That is a completely different business from renting video cassette tapes. The VPPA does not address it.”

Paramount further argued that Salazar’s case isn’t a good vehicle to consider the “consumer” definition because his “complaint fails for multiple additional reasons that could complicate further review.”

Paramount wasn’t able to convince the Supreme Court that the case isn’t worth taking up, however. SCOTUSblog says that “the case will likely be scheduled for oral argument in the court’s 2026-27 term,” which begins in October 2026.

Supreme Court to decide how 1988 videotape privacy law applies to online video Read More »