There may not be a safe off-ramp for some taking GLP-1 drugs, study suggests

Of the 308 who benefited from tirzepatide, 254 (82 percent) regained at least 25 percent of the weight they had lost on the drug by week 88. Further, 177 (57 percent) regained at least 50 percent, and 74 (24 percent) regained at least 75 percent. Generally, the more weight people regained, the more their cardiovascular and metabolic health improvements reversed.

Data gaps and potential off-ramps

On the other hand, there were 54 participants of the 308 (17.5 percent) that didn’t regain a significant amount of weight (less than 25 percent.) This group saw some of their health metrics worsen on withdrawal of the drug, but not all— blood pressure increased a bit, but cholesterol didn’t go up significantly overall. About a dozen participants (4 percent of the 308) continued to lose weight after stopping the drug.

The researchers couldn’t figure out why these 54 participants fared so well; there were “no apparent differences” in demographic or clinical characteristics, they reported. It’s clear the topic requires further study.

But, overall, the study offers a gloomy outlook for patients hoping to avoid needing to take anti-obesity drugs for the foreseeable future.

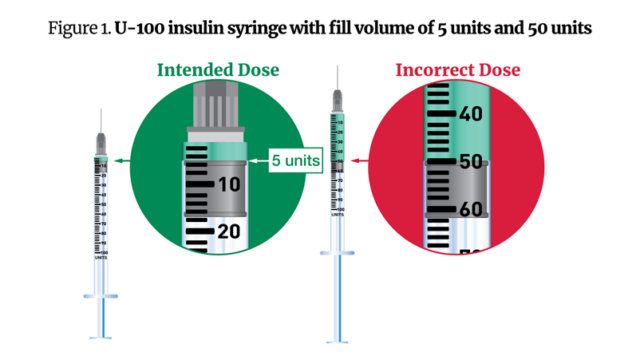

Oczypok and Anderson highlight that the study involved an abrupt withdrawal from the drug. In contrast, many patients may be interested in slowly weaning off the drugs, stepping down dosage levels over time. So far, data on this strategy and the protocols to pull it off have little data behind them. It also might not be an option for patients who abruptly lose access or insurance coverage of the drugs. Other strategies for weaning off the drugs could involve ramping up physical activity or calorie restriction in anticipation of dropping the drugs, the experts note.

In addition to more data on potential GLP-1 off-ramps, the pair calls for more data on the effects of weight fluctuations from people going on and off the treatment. At least one study has found that the regained weight after intentional weight loss may end up being proportionally higher in fat mass, which could be harmful.

For now, Oczypok and Anderson say doctors should be cautious about talking with patients about these drugs and what the future could hold. “These results add to the body of evidence that clinicians and patients should approach starting [anti-obesity medications] as long-term therapies, just as they would medications for other chronic diseases.”

There may not be a safe off-ramp for some taking GLP-1 drugs, study suggests Read More »