Trump to sign stablecoin bill that may make it easier to bribe the president

Donald Trump’s first big crypto win “nothing to crow about,” analyst says.

Donald Trump is expected to sign the GENIUS Act into law Friday, securing his first big win as a self-described “pro-crypto president.” The act is the first major piece of cryptocurrency legislation passed in the US.

The House of Representatives voted to pass the GENIUS Act on Thursday, approving the same bill that the Senate passed last month. The law provides a federal framework for stablecoins, a form of cryptocurrency that’s considered less volatile than other cryptocurrencies, as each token is backed by the US dollar or other supposedly low-risk assets.

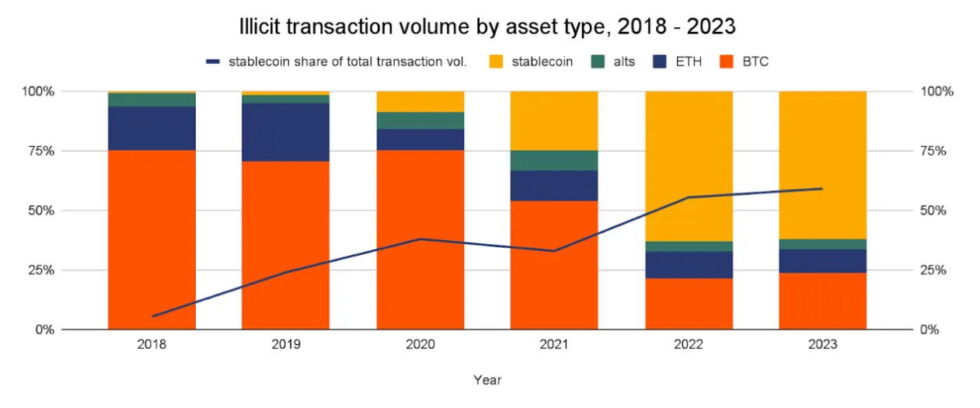

The GENIUS Act is expected to spur more widespread adoption of cryptocurrencies, since stablecoins are often used to move funds between different tokens. It could become a gateway for many Americans who are otherwise shy about investing in cryptocurrencies, which is what the industry wants. Ahead of Thursday’s vote, critics had warned that Republicans were rushing the pro-industry bill without ensuring adequate consumer protections, though, seemingly setting Americans up to embrace stablecoins as legitimate so-called “cash of the blockchain” without actually insuring their investments.

A big concern is that stablecoins will appear as safe investments, legitimized by the law, while supposedly private companies issuing stablecoins could peg their tokens to riskier assets that could tank reserves, cause bank runs, and potentially blindside and financially ruin Americans. Stablecoin scams could also target naïve stablecoin investors, luring them into making deposits that cannot be withdrawn.

Rep. Maxine Waters (D-Calif.)—part of a group of Democrats who had strongly opposed the bill—further warned Thursday that the GENIUS Act prevents lawmakers from owning or promoting stablecoins, but not the president. Trump and his family have allegedly made more than a billion dollars through their crypto ventures, and Waters is concerned that the law will make it easier for Trump and other presidents to use the office to grift and possibly even obscure foreign bribes.

“By passing this bill, Congress will be telling the world that Congress is OK with corruption, OK with foreign companies buying influence,” Waters said Thursday, CBS News reported.

Some lawmakers fear such corruption is already happening. Senators previously urged the Office of Government Ethics in a letter to investigate why “a crypto firm whose founder needs a pardon” (Binance’s Changpeng Zhao, also known as “CZ”) “and a foreign government spymaker coveting sensitive US technology” (United Arab Emirates-controlled MGX) “plan to pay the Trump and Witkoff families hundreds of millions of dollars.”

The White House continues to insist that Trump has “no conflicts of interest” because “his assets are in a trust managed by his children,” Reuters reported.

Ultimately, Waters and other Democrats failed to amend the bill to prevent presidents from benefiting from the stablecoin framework and promoting their own crypto projects.

Markets for various cryptocurrencies spiked Thursday, as the industry anticipates that more people will hold crypto wallets in a world where it’s fast, cheap, and easy to move money on the blockchain with stablecoins, as compared to relying on traditional bank services. And any fees associated with stablecoin transfers will likely be paid with other forms of cryptocurrencies, with a token called ether predicted to benefit most since “most stablecoins are issued and transacted on the underlying blockchain Ethereum,” Reuters reported.

Unsurprisingly, ether-linked stocks jumped Friday, with the token’s value hitting a six-month high. Notably, Bitcoin recently hit a record high; it was valued at above $120,000 as the stablecoin bill moved closer to Trump’s desk.

GENIUS Act plants “seeds for the next financial crisis”

As Trump prepares to sign the law, Consumer Reports’ senior director monitoring digital marketplaces, Delicia Hand, told Ars that the group plans to work with other consumer advocates and the implementing regulator to try to close any gaps in the stablecoin legislation that would leave Americans vulnerable.

Some Democrats supported the GENIUS Act, arguing that some regulation is better than none as cryptocurrency activity increases globally and the technology has the potential to revolutionize the US financial system.

But Hand told Ars that “we’ve already seen what happens when there are no protections” for consumers, like during the FTX collapse.

She joins critics that the BBC reported are concerned that stablecoin investors could get stuck in convoluted bankruptcy processes as tech firms engage more and more in “bank-like activities” without the same oversight as banks.

The only real assurances for stablecoin investors are requirements that all firms must publish monthly reserves backing their tokens, as well as annual statements required from the biggest companies issuing tokens. Those will likely include e-commerce and digital payments giants like Amazon, PayPal, and Shopify, as well as major social media companies.

Meanwhile, Trump seemingly wants to lure more elderly people into investing in crypto, reportedly “working on a presidential order that could allow retirement accounts to be invested in private assets, such as crypto, gold, and private equity,” the BBC reported.

Waters, a top Democrat on the House Financial Services Committee, is predicting the worst. She has warned that the law gives “Trump the pen to write the rules that would put more money in his family’s pocket” while causing “consumer harm” and planting “the seeds for the next financial crisis.”

Analyst: End of Trump’s crypto wins

The House of Representatives passed two other crypto bills this week, but those bills now go to the Senate, where they may not have enough support to pass.

The CLARITY Act—which creates a regulatory framework for digital assets and cryptocurrencies to allow for more innovation and competition—is “absolutely the most important thing” the crypto industry has been pushing since spending more than $119 million backing pro-crypto congressional candidates last year, a Coinbase policy official, Kara Calvert, told The New York Times.

Republicans and industry see the CLARITY Act as critical because it strips the Securities and Exchange Commission of power to police cryptocurrencies and digital assets and gives that power instead to the Commodity Futures Trading Commission, which is viewed as friendlier to industry. If it passed, the CLARITY Act would not just make it harder for the SEC to raise lawsuits, but it would also box out any future SEC officials under less crypto-friendly presidents from “bringing any cases for past misconduct,” Amanda Fischer, a top SEC official under the Biden administration, told the NYT.

“It would retroactively bless all the conduct of the crypto industry,” Fischer suggested.

But Senators aren’t happy with the CLARITY Act and expect to draft their own version of the bill, striving to lay out a crypto market structure that isn’t “reviled by consumer protection groups,” the NYT reported.

And the other bill that the House sent to the Senate on Thursday—which would ban the US from creating a central bank digital currency (CBDC) that some conservatives believe would allow for government financial surveillance—faces an uphill battle, in part due to Republicans seemingly downgrading it as a priority.

The anti-CBDC bill will likely be added to a “must-pass” annual defense policy bill facing a vote later this year, the NYT reported. But Rep. Marjorie Taylor Greene (R.-Ga.) “mocked” that plan, claiming she did not expect it to be “honored.”

Terry Haines, founder of the Washington-based analysis firm Pangaea Policy, has forecasted that both the CLARITY Act and the anti-CBDC bills will likely die in the Senate, the BBC reported.

“This is the end of crypto’s wins for quite a while—and the only one,” Haines suggested. “When the easy part, stablecoin, takes [approximately] four to five years and barely survives industry scandals, it’s not much to crow about.”

Trump to sign stablecoin bill that may make it easier to bribe the president Read More »