11 years after launch, 49M people still use their PS4s, matching the PS5

Gone, but not PS4-gotten —

But PS5 users spend more money and gameplay time on their consoles.

Enlarge / After nearly four years of the PS5, a lot of people are still using their old PS4s.

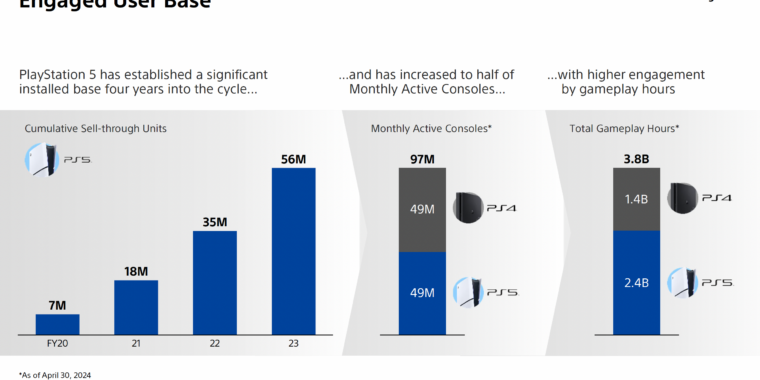

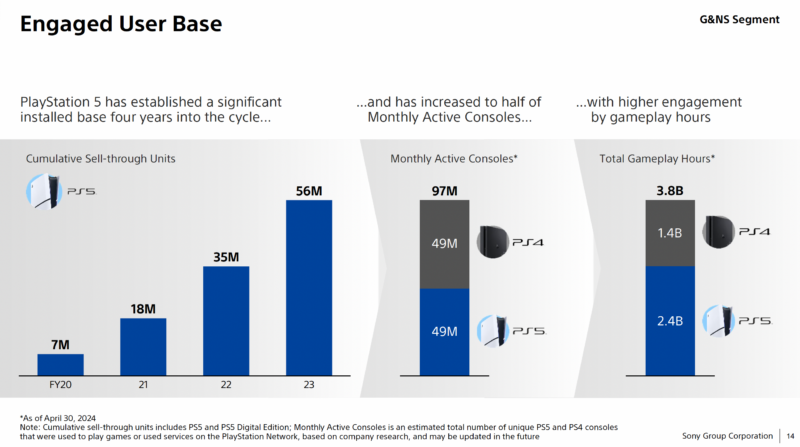

If you’re still getting use out of your aging PS4 after nearly four full years of PS5 availability, new data from Sony shows you are far from alone. The Japanese electronics giant says that both the PS4 and PS5 currently have about 49 million monthly active users, suggesting a significant number of PlayStation players have yet to spend $400 or more to upgrade to the newer console.

The new data comes from an extensive Game & Network Services report presented as part of Sony’s most recent Business Segment Meeting. Those numbers suggest that about 42 percent of the 117 million PS4 units ever sold are still in active use, compared to 86 percent of the 56 million PS5 units sold thus far.

Despite the parity in active consoles, Sony also points out that the PS5 is responsible for significantly more gameplay hours than the PS4: 2.4 billion for the new system compared to 1.4 billion for its predecessor (it’s unclear what time period this comparison covers). Sony’s monthly user numbers also include any console “used to play games or [access] services on the PlayStation Network,” so an old PS4 that serves as a convenient Netflix box in the spare bedroom would still inflate the older system’s numbers here.

Still, it’s pretty impressive that nearly 50 million people are still regularly using a console first launched in 2013 (even considering 2016’s Pro upgrade). That could be in part because the PS4 is still seeing plenty of software support well after the PS5’s release; Sony’s PSN Store listings currently include 189 “just released” PS4-compatible games, including many “best-selling” titles that don’t require a PS5 at all. The fact that those PS4-compatible titles are also playable directly on the PS5 has probably helped convince some publishers to target the older console for their less graphics-intensive games.

Enlarge / PS5 owners are spending less money on full games and a lot more money on “add-on content.”

The PS4’s longevity doesn’t seem to have had a significant negative impact on the PS5’s bottom line, either. Sony’s gaming division has already earned $10 billion in profit off of $106 billion in sales across the nearly four years of the PS5 generation, compared to $9 billion in profit off $107 billion in sales across seven years of the PS4.

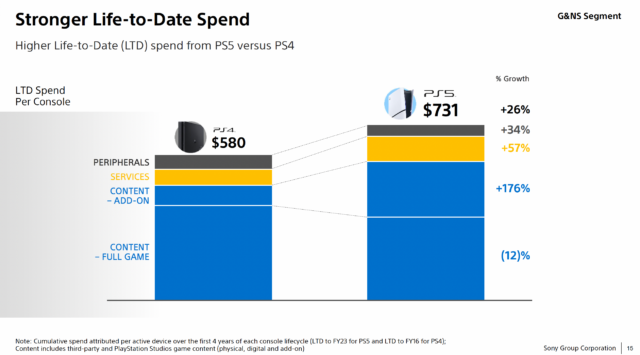

PS5 owners have spent an average of $731 each across games, services, peripherals, and add-on content. That’s up significantly from $580 in nominal spending from the average PS4 owner at the same point in that console’s life cycle, though what sounds like a big increase is actually pretty flat when you take inflation into account.

That per-console gaming spending is now concentrated less on “full game” purchases—which are down 12 percent between the PS4 to PS5 generation—and much more on so-called add-on content—which is up 176 percent between generations. We’re guessing that big-spending, loot-box-chasing “whales” have something to do with that increase.

Listing image by Sam Machkovech

11 years after launch, 49M people still use their PS4s, matching the PS5 Read More »