Big Pharma spends billions more on executives and stockholders than on R&D

Greed —

Senate report points to greed and “patent thickets” as key reasons for high prices.

When big pharmaceutical companies are confronted over their exorbitant pricing of prescription drugs in the US, they often retreat to two well-worn arguments: One, that the high drug prices cover costs of researching and developing new drugs, a risky and expensive endeavor, and two, that middle managers—pharmacy benefit managers (PBMs), to be specific—are actually the ones price gouging Americans.

Both of these arguments faced substantial blows in a hearing Thursday held by the Senate Committee on Health, Education, Labor and Pensions, chaired by Sen. Bernie Sanders (I-Vt.). In fact, pharmaceutical companies are spending billions of dollars more on lavish executive compensation, dividends, and stock buyouts than they spend on research and development (R&D) for new drugs, Sanders pointed out. “In other words, these companies are spending more to enrich their own stockholders and CEOs than they are in finding new cures and new treatments,” he said.

And, while PBMs certainly contribute to America’s uniquely astronomical drug pricing, their profiteering accounts for a small fraction of the massive drug market, Sanders and an expert panelist noted. PBMs work as shadowy middle managers between drugmakers, insurers, and pharmacies, setting drug formularies and consumer prices, and negotiating rebates and discounts behind the scenes. Though PBMs practices contribute to overall costs, they pale compared to pharmaceutical profits.

Rather, the heart of the problem, according to a Senate report released earlier this week, is pharmaceutical greed, patent gaming that allows drug makers to stretch out monopolies, and powerful lobbying.

On Thursday, the Senate committee gathered the CEOs of three behemoth pharmaceutical companies to question them on the drug pricing practices: Robert Davis of Merck, Joaquin Duato of Johnson & Johnson, and Chris Boerner of Bristol Myers Squibb.

“We are aware of the many important lifesaving drugs that your companies have produced, and that’s extraordinarily important,” Sanders said before questioning the CEOs. “But, I think, as all of you know, those drugs mean nothing to anybody who cannot afford it.”

America’s uniquely high prices

Sanders called drug pricing in the US “outrageous,” noting that Americans spend by far the most for prescription drugs in the world. A report this month by the US Department of Health and Human Services found that in 2022, US prices across all brand-name and generic drugs were nearly three times as high as prices in 33 other wealthy countries. That means that for every dollar paid in other countries for prescription drugs, Americans paid $2.78. And that gap is widening over time.

Focusing on drugs from the three companies represented at the hearing (J&J, Merck, and Bristol Myers Squibb), the Senate report looked at how initial prices for new drugs entering the US market have skyrocketed over the past two decades. The analysis found that from 2004 to 2008, the median launch price of innovative prescription drugs sold by J&J, Merck, and Bristol Myers Squibb was over $14,000. But, over the past five years, the median launch price was over $238,000. Those numbers account for inflation.

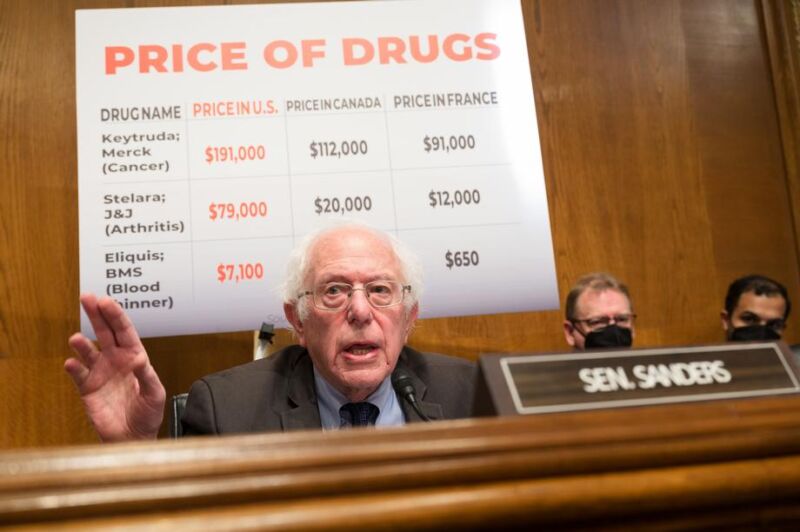

The report focused on high-profit drugs from each of the drug makers. Merck’s Keytruda, a cancer drug, costs $191,000 a year in the US, but is just $91,000 in France and $44,000 in Japan. J&J’s HIV drug, Symtuza, is $56,000 in the US, but only $14,000 in Canada. And Bristol Myers Squibb’s Eliquis, used to prevent strokes, costs $7,100 in the US, but $760 in the UK and $900 in Canada.

Sanders asked Bristol Myers Squibb’s CEO Boerner if the company would “reduce the list price of Eliquis in the United States to the price that you charge in Canada, where you make a profit?” Boerner replied that “we can’t make that commitment primarily because the prices in these two countries have very different systems.”

The powerful pharmaceutical trade group PhRMA, published a blog post before the hearing saying that comparing US drug prices to prices in other countries “hurts patients.” The group argued that Americans have broader, faster access to drugs than people in other countries.

Big Pharma spends billions more on executives and stockholders than on R&D Read More »