UK regulators plan to force Google changes under new competition law

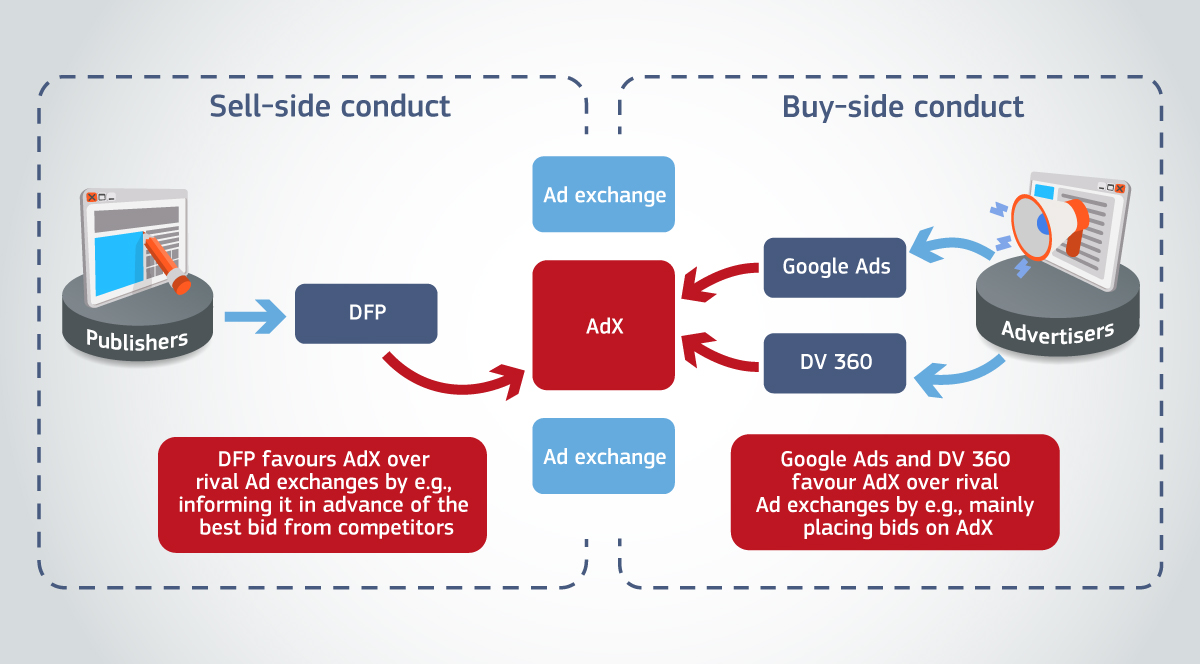

Google is facing multiple antitrust actions in the US, and European regulators have been similarly tightening the screws. You can now add the UK to the list of Google’s governmental worries. The country’s antitrust regulator, known as the Competition and Markets Authority (CMA), has confirmed that Google has “strategic market status,” paving the way to more limits on how Google does business in the UK. Naturally, Google objects to this course of action.

The designation is connected to the UK’s new digital markets competition regime, which was enacted at the beginning of the year. Shortly after, the CMA announced it was conducting an investigation into whether Google should be designated with strategic market status. The outcome of that process is a resounding “yes.”

This label does not mean Google has done anything illegal or that it is subject to immediate regulation. It simply means the company has “substantial and entrenched market power” in one or more areas under the purview of the CMA. Specifically, the agency has found that Google is dominant in search and search advertising, holding a greater than 90 percent share of Internet searches in the UK.

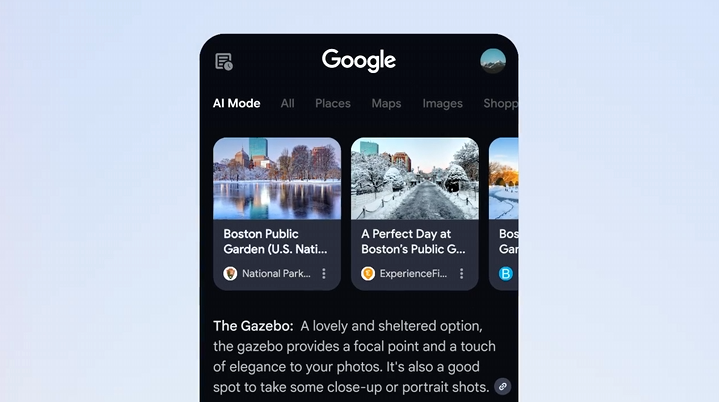

In Google’s US antitrust trials, the rapid rise of generative AI has muddied the waters. Google has claimed on numerous occasions that the proliferation of AI firms offering search services means there is ample competition. In the UK, regulators note that Google’s Gemini AI assistant is not in the scope of the strategic market status designation. However, some AI features connected to search, like AI Overviews and AI Mode, are included.

According to the CMA, consultations on possible interventions to ensure effective competition will begin later this year. The agency’s first set of antitrust measures will likely expand on solutions that Google has introduced in other regions or has offered on a voluntary basis in the UK. This could include giving publishers more control over how their data is used in search and “choice screens” that suggest Google alternatives to users. Measures that require new action from Google could be announced in the first half of 2026.

UK regulators plan to force Google changes under new competition law Read More »